Fixed Assets, Depreciation Expense, and Accumulated Depreciation

PlanGuru makes it easy to forecast capital expenditures, depreciation expense, and accumulated depreciation in a way that keeps your Balance Sheet, Income Statement, and Cash Flow perfectly aligned.

Accounts added to the Property & Equipment section can be defined as one of two account types:

| Account Type | Purpose |

|---|---|

| 🟢 Asset | Used to forecast capital expenditures (CapEx) and additions to fixed assets |

| 🔵 Accumulated Depreciation | Used to forecast the reduction in asset value over time |

By linking these with a Depreciation Expense account on the Income Statement, PlanGuru automatically handles the full depreciation cycle.

When to Use This Setup

Use this configuration when you want to:

-

Forecast capital additions (e.g., equipment purchases, leasehold improvements, vehicles, software).

-

Calculate monthly depreciation expense based on asset values.

-

Track the accumulated depreciation balance automatically.

-

Keep your cash flow and net asset values up to date in your forecasts.

Step-by-Step Setup

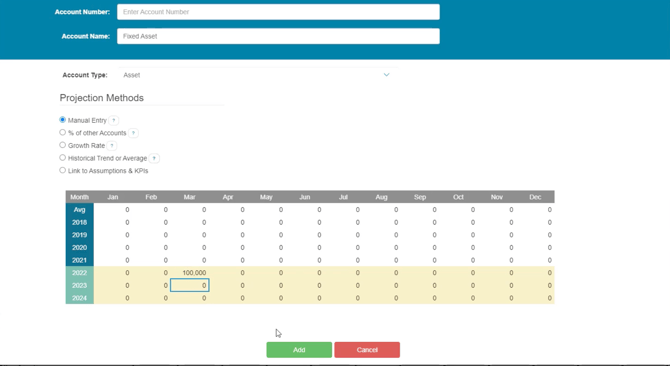

Step 1 – Add a Fixed Asset Account

-

Go to the Balance Sheet → Property & Equipment section.

-

Right-click and select Add Account.

-

Name the account (e.g., Fixed Asset – Equipment).

-

Keep the Account Type set to Asset.

-

Enter a capital addition — for example, $100,000 in March.

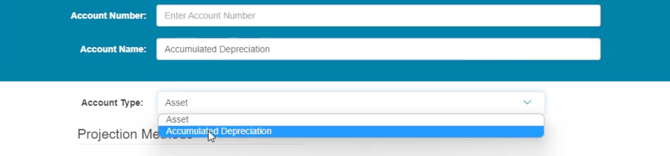

Step 2 – Add an Accumulated Depreciation Account

-

Right-click again in the same section and select Add Account.

-

Name it (e.g., Accumulated Depreciation – Equipment).

-

Change the Account Type to Accumulated Depreciation.

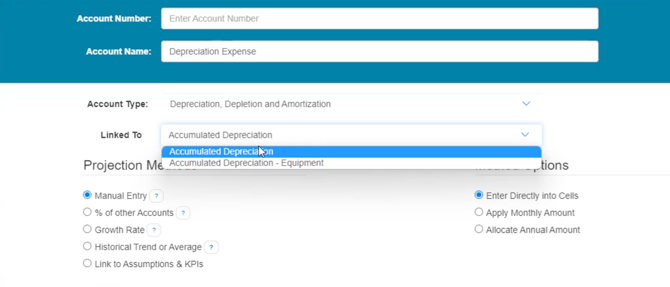

Step 3 – Add a Depreciation Expense Account

-

Navigate to the Income Statement.

-

Right-click and select Add Account.

-

Name it (e.g., Depreciation Expense – Equipment).

-

Change the Account Type to Depreciation Expense.

-

Link this account to the corresponding Accumulated Depreciation account on the Balance Sheet.

💡 Tip:

If you have multiple asset categories (e.g., furniture, vehicles, software), create separate Depreciation Expense and Accumulated Depreciation accounts for each.

Even if these don’t exist in your accounting system, adding them in PlanGuru improves visibility and reporting accuracy.

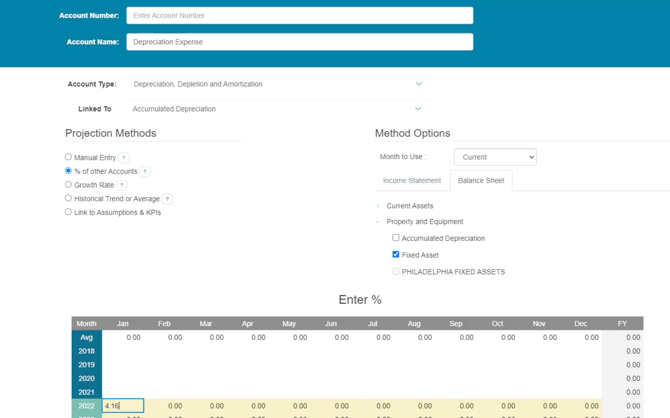

Step 4 – Forecast Depreciation Expense

Use the Percent of Other Account projection method for the Depreciation Expense account:

-

Double-click or right-click → Edit the Depreciation Expense line.

-

Select % of Other Account.

-

Link it to the Fixed Asset account.

-

Enter the appropriate depreciation rate (e.g., 4.16% per month for a 2-year useful life).

Formula Example:

100% ÷ 24 months = 4.16% per month

After 24 months, revert the percentage to 0% to stop depreciation once the asset is fully written down.

Step 5 – Review the Results

After applying the method:

-

The Depreciation Expense will calculate monthly based on the asset’s value and defined percentage.

-

The Accumulated Depreciation balance will automatically increase as expenses are recorded.

-

The Net Book Value (Asset minus Accumulated Depreciation) will adjust accordingly.

Income Statement:

![]()

Balance Sheet:

![]()

Linking Cash Flow

Because PlanGuru automatically connects these accounts:

-

Asset additions decrease cash (CapEx outflow).

-

Depreciation expense does not affect cash (non-cash expense).

-

The Cash Flow Statement correctly categorizes additions under Investing Activities and depreciation under Operating Activities (adjustment to net income).