Average Days to Collect

Average Days to Collect projection method is used to project the average collection period for A/R accounts

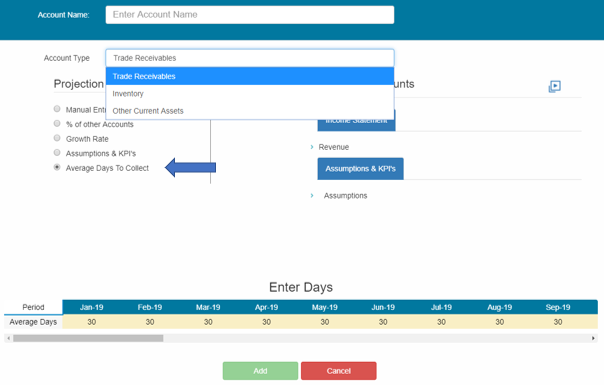

The Average Days to Collect projection method is used to project the average collection period for A/R accounts. This projection method can be accessed in the "Trade Receivables" Account Type found in the Current Liabilities section in the Balance Sheet.

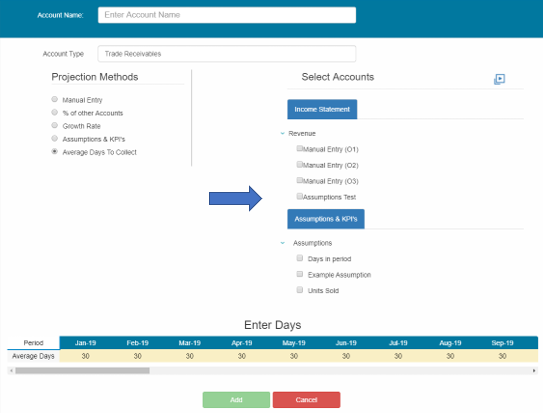

Once the "Average Days to Collect" method has been selected, you'll be given the option to select accounts to link to the projection. You can select accounts either from the revenue section of the income statement, or accounts from the Assumptions & KPI's tab.

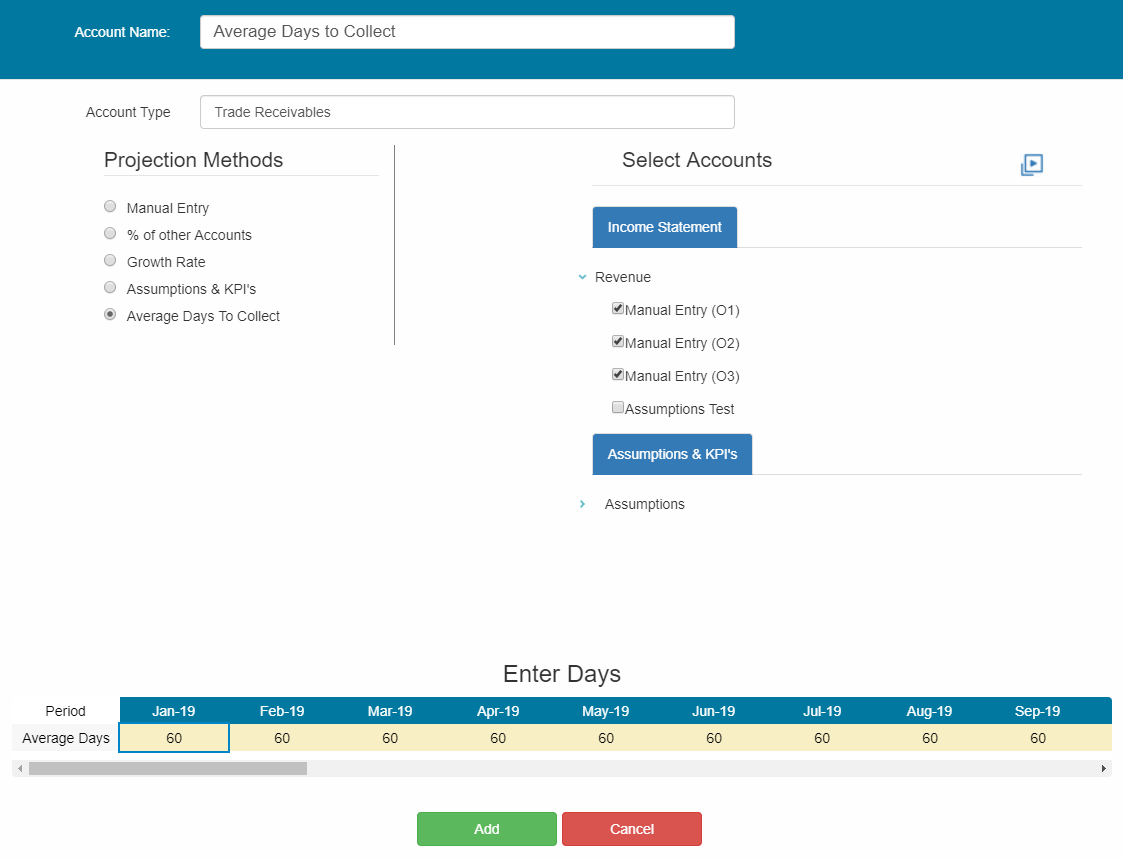

You can select multiple accounts to have linked to the same average days to collect account, but note that they will all use the same average days calculation that you have entered in the "Enter Days" section. If you want to apply different average days to collect projections to different A/R accounts, you will have to create separate Average Days to Collect accounts in the Balance Sheet.

Once you have checked the account(s) that you would like to have linked to the Average Days to collect method, you can then enter the average days in the "Enter Days" tool. You can find this tool on the bottom of the add/edit tool in an Average Days to Collect projection method account.

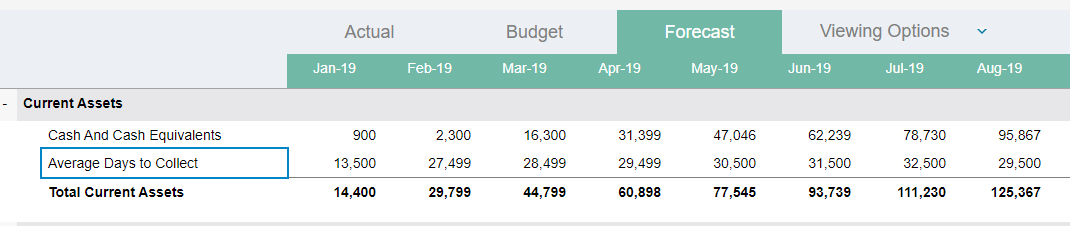

As you can see in the example above, I have selected three revenue accounts to be linked, and entered an average days to collect of 60 days. Here's what this example will look like once applied to the balance sheet: