Accrued Expenses - Capturing their balance sheet and cash flow impact

Many times, when forecasting expenses there is a difference in the timing of expense recognition and resulting cash outflow. Accurately modeling these two considerations is crucial to understanding future profitability and cash flow.

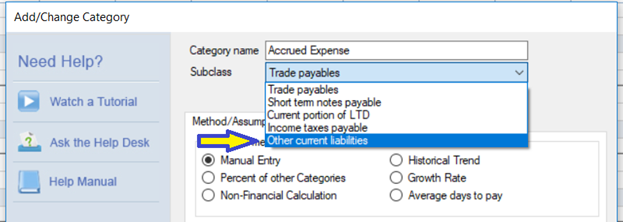

There are several ways to forecast accrued expenses including their balance sheet and cash flow impact, but by far the simplest method is to use the Accrued expenses projection method found under the Other current liabilities subclass.

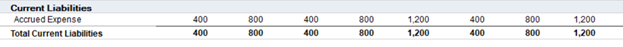

For example, let’s say you have a $400 expense that gets recognized each month, but only gets paid quarterly starting in March.

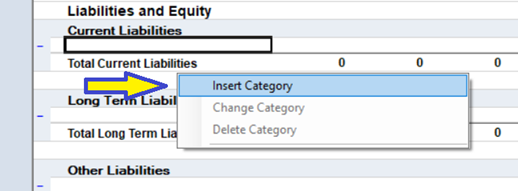

Step 1 -Add a new category under the Other Current Liabilities class

Step 2 - Define the category subclass as "Other Current Liabilities"

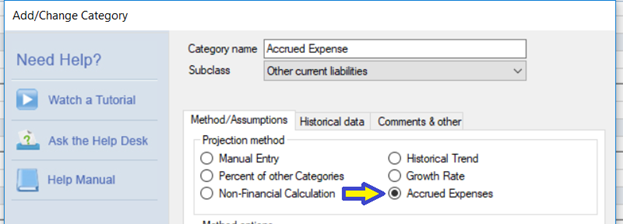

Step 3 - Select the Accrued Expenses Forecast method

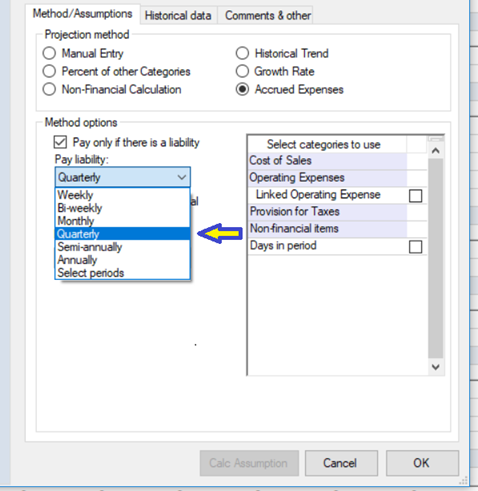

Step 4 - Select the "Pay Liability" interval. You have a number of options, in this case I'll select quarterly.

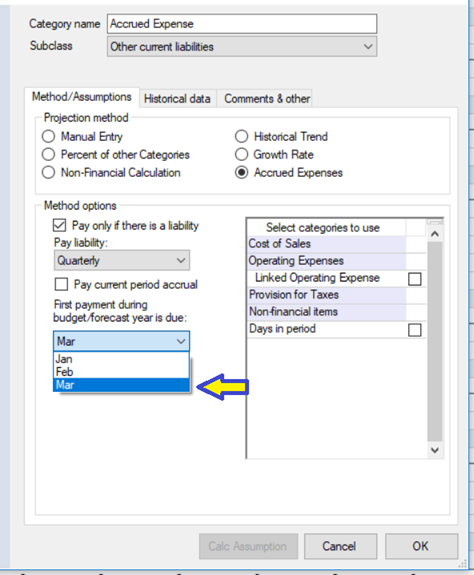

Step 5 - Select the first period you'd like to pay the liability. In this case I'll select March.

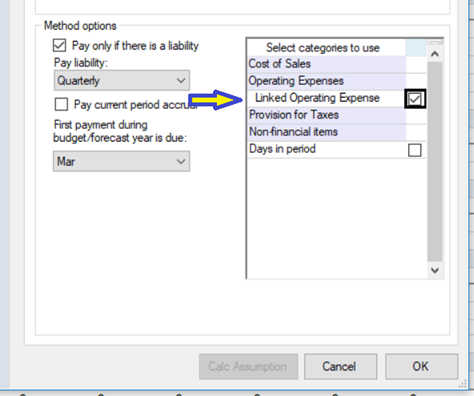

Step 6 - Select which Expense or Non-Financial category you'd like to accrue on your balance sheet and pay according to the payment terms defined in steps 4 & 5. Then click "OK".

The result is an accrued liability that gets paid on a quarterly basis starting in March.