A/R Calculation - Multiple customers with different payment terms

Customers ask us all the time if they can model receivable in a way that accommodates multiple customers with different payment terms. There are two ways this can be done, the method you chose depends on your financial statement preferences.

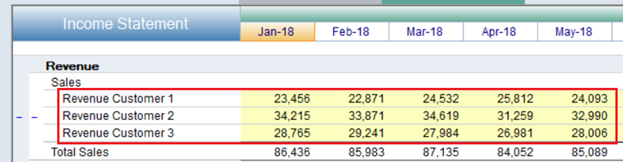

Option 1:

Created multiple Revenue & Receivable accounts, one for each customer.

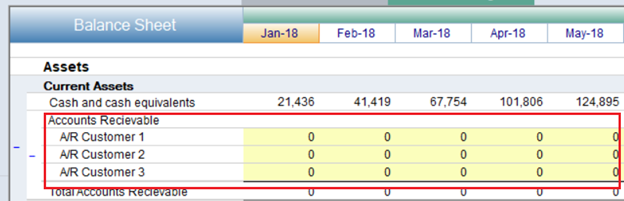

Once these accounts are set up on the Income Statement and Balance Sheet, forecast each customer’s receivable account using the "Average Days to Collect" Method, linking it to that customers revenue account. Repeat this for each customer, entering in the appropriate payment terms in the "Average days to collect" field.

Option 2:

If you only want to maintain one sales and receivable account on your financial statements Option 2 will allow you to accomplish the same thing using the Non-Financial Data tab. Option 1 is a much simpler way to achieve this goal, however option 2 is just as effective and should only take a few more minutes to setup.

In this example the logic for customer 1 will be explored, to see the rest of Option 2 in action, save the attached analysis files into your PlanGuru data file path. If you don't know where to save these files so that you can use them, read this knowledge base post, it will explain everything you need to know. https://help.planguru.com/entries/20311236-locating-sending-and-receiving-planguru-2011-data-files

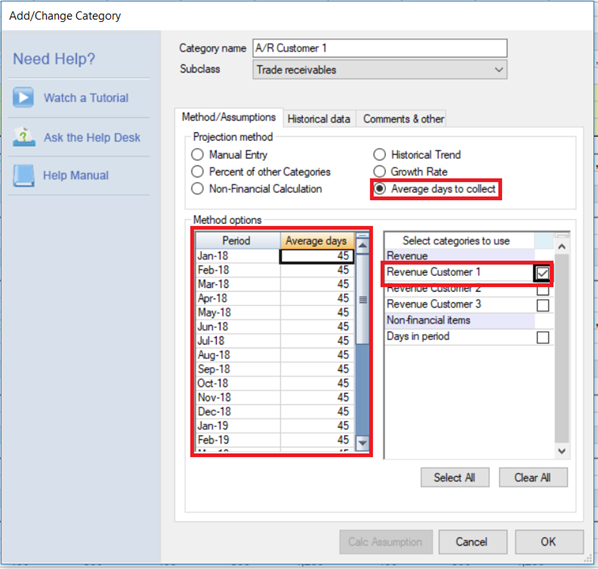

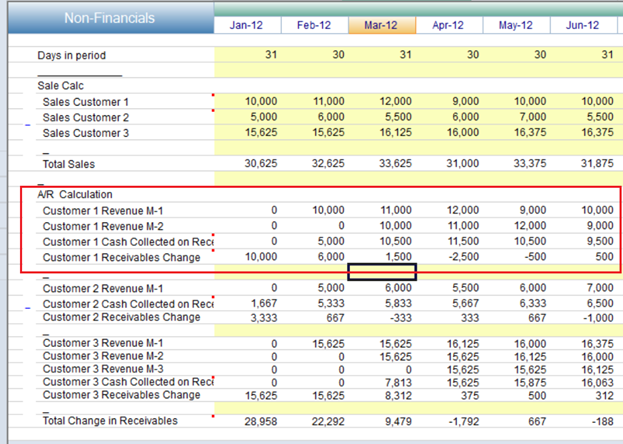

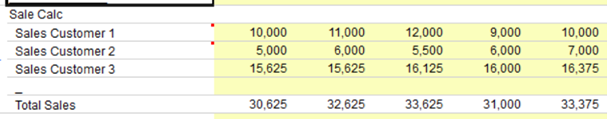

The First Thing you will need to do is break out sales by client by creating categories on the Non-Financial data tab. You can then total this number and link it to an appropriate revenue account.

We can then build out the logic used to calculate A/R for a single client like so.

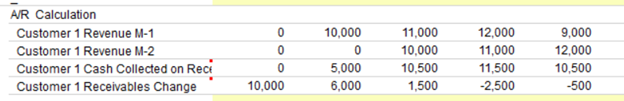

For Customer 1, receivables are calculated as follows. Average days to collect can be expressed as a number of days, say 15, or by saying we expect to collect 1/2 of this month's sales in the current month, and the remaining half of this month’s sales next month. In this example M-1 represents the current months accounts receivable while M-2 represents last months.

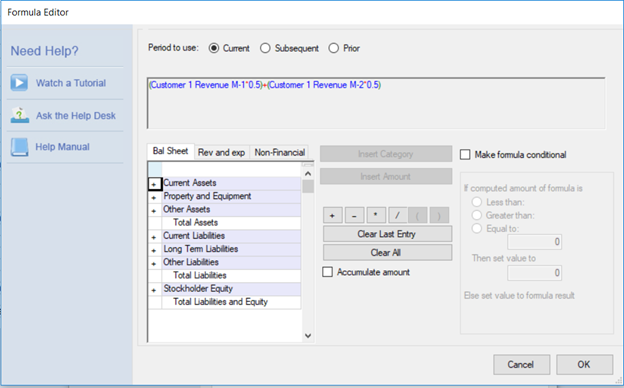

We then calculate the current months A/R, represented here for this customer by “Customer 1 Cash Collected on Receivables”, by taking half of the current months accounts receivable and adding it to half of last month’s accounts receivable.

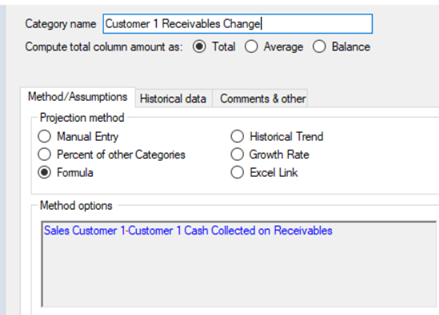

Next we calculate the change in receivables for the customer during the current period.

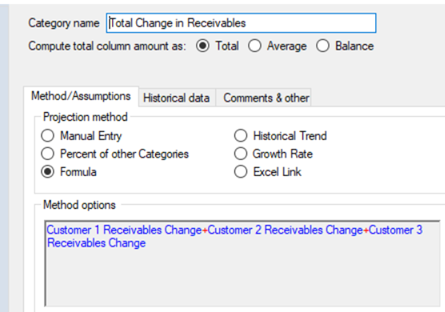

The add up the receivables change for each customer to get the total change in receivables for the month.

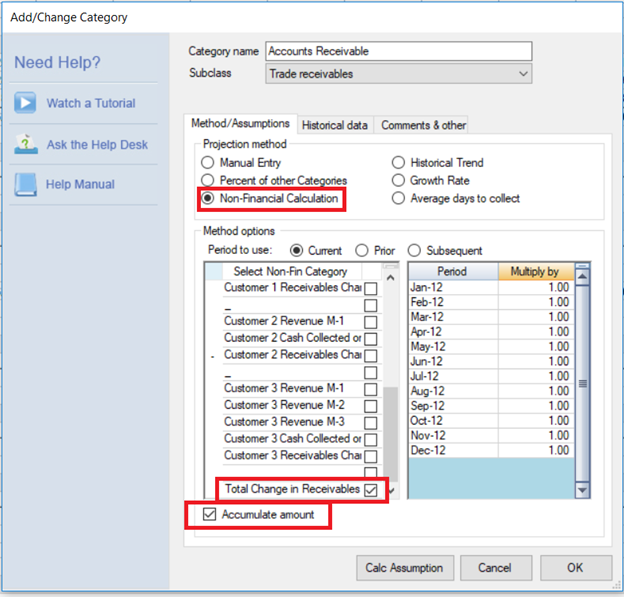

We can then link this to an asset account with the Subclass Trade receivables on the balance sheet using the Non-Financial Calculation projection method. Note that we checked the accumulate amount checkbox.

Download Demo Multi Customers and different payment terms.zip